What Does Pmi Stand for in Finance

PMITM by IHS Markit

Use the Purchasing Managers' Index (PMI) for accurate and timely insight into the health of the global economy.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities. PMI FAQ available. Watch a short video on how to use PMI.

Learn more about Purchasing Managers' Index® (PMI®)

Do you have the data you need to nowcast with confidence? Use our purchasing managers index data

Investment Manager Index (IMI) Survey Unlock comprehensive monthly insights into investor sentiment

Key benefits of PMI data

![]()

Timeliness

PMI data are released monthly, in advance of comparable official economic data

![]()

Comparability

PMI data are compiled using proven standardized methodology, with indices available for over 40 countries

![]()

Factual

PMI data are compiled from survey questions tracking actual changes in business volumes such as output, not sentiment-based questions

![]()

No revisions

Unlike many official economic indicators, PMI data are not revised after publication

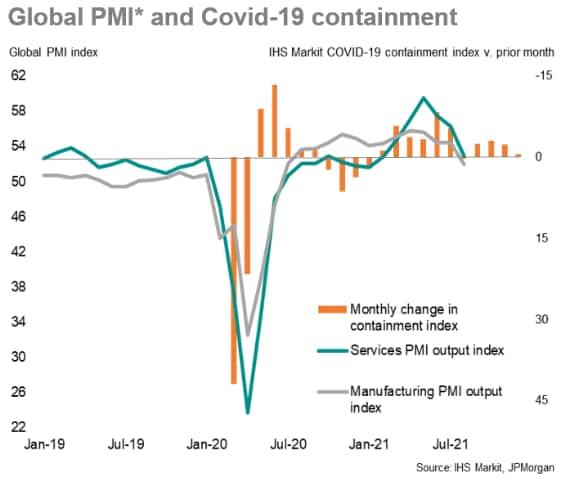

Global PMI summary as of September 2021

- The global economy expanded for a fourteenth straight month in August

- The rate of expansion was the slowest since January.

- Both manufacturing and service sectors contributed to the easing of growth as COVID-19 cases rose around the world and induced further caution.

- Impeded by sustained supply-side constraints, global manufacturing growth fell to the lowest in 14 months.

- PMI sub-indices also showed a lengthening of average supplier lead times to an extent exceeded only twice in the survey's 23-year history, linked in turn to yet another steep rise in prices and underscoring the unprecedented supply chain pressures faced by firms.

Stay up-to-date with timely insight into the health of the global economy through PMI™ Commentary and Analysis

PMI enables

Asset management firms

By tracking relative national and sector growth, productivity, profit margin and price trends, PMI data are used in asset allocation models and strategies, and in portfolio performance analysis.

Equity and fixed income desks

National PMI data are indicative of changing macroeconomic conditions, with detailed sector data providing further guidance for equity and bond price trends, earnings analysis, dividend forecasting and default probability.

Commodity and FX desks

With advance signals of interest rate, economic growth and inflation trends, as well as commodity supply and demand patterns and resulting price changes, foreign exchange and commodity traders are able to seek out new opportunities.

Corporate business planners

Financial planners and strategists benefit from a better understanding of how the economic environment is changing by country and sector, and what this means for key markets, industries and competitors, as well as their own company's performance.

Supply chain managers

The PMI is an essential tool for benchmarking and forecasting sales, inventory and price trends, monitoring supply and demand, and tracking supplier performance.

Central banks

PMI data provide the most up to date assessment of current economic conditions, are highly correlated with central bank policy decisions and have frequently been instrumental in changes to monetary policy.

Methodology and coverage

Survey methodology

Each national PMI dataset is compiled from questionnaire responses from a survey panel of senior purchasing executives (or similar) at around 400 companies. The survey panels are carefully recruited to accurately represent the true structure of the monitored sector: manufacturing, services, construction or the entire private sector economy.

The survey questionnaire covers the following economic variables:

| Manufacturing Output New orders New export orders Backlogs of work Output prices Input prices Suppliers' delivery times Stocks of finished goods Quantity of purchases Stocks of purchases Employment Future output | Services Business activity New business New export business Outstanding business Prices charged Input prices Employment Future activity | Whole Economy Output New orders New export orders Backlogs of work Output prices Overall input prices Purchase prices Staff costs Suppliers' delivery times Quantity of purchases Stocks of purchases Employment Future output | Construction Total activity Residential activity Commercial activity Civil engineering activity New orders Employment Quantity of purchases Suppliers' delivery times Input prices Sub-contractor usage Sub-contractor availability Sub-contractor rates Sub-contractor quality Future activity |

Questionnaires are completed in the second half of each month, and survey results are then processed by our economists. For each variable, panel members are asked to report an increase, decrease or no change compared with the previous month, and to provide reasons for any changes.

Index methodology

PMI indices are calculated as diffusion indices. For each variable, the index is the sum of the percentage of 'higher' responses and half the percentage of 'no change' responses. The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted using an in-house method developed by IHS Markit.

PMI indices are only available via subscription with the exception of a headline index. The headline index influences financial markets and receives considerable media coverage upon release. The headline index is calculated differently depending on the sector being monitored:

Manufacturing and Whole Economy

The headline figure is the Purchasing Managers' Index™ (PMI). The PMI is a weighted average of the following five indices: New Orders (30%), Output (25%), Employment (20%), Suppliers' Delivery Times (15%) and Stocks of Purchases (10%). For the PMI calculation the Suppliers' Delivery Times Index is inverted so that it moves in a comparable direction to the other indices.

Services

The headline figure is the Services Business Activity Index. This is a diffusion index calculated from a question that asks for changes in the volume of business activity compared with one month previously. The Services Business Activity Index is comparable to the Manufacturing Output Index.

Construction

The headline figure is the Total Activity Index. This is a diffusion index that tracks changes in the total volume of construction activity compared with one month previously. The Total Activity Index is comparable to the Manufacturing Output Index and Services Business Activity Index.

Learn more about the PMI survey methodology.

Using PMI data

PMI datasets are used by governments, financial institutions and corporates for forecasting, analysis and planning, helping to monitor key economic variables:

- GDP

- Manufacturing output / service sector output

- CPI/inflation indicators

- Producer input prices

- Exports and trade flow indices

- Employment/non-farm payrolls

- Productivity

- Profitability

- Factory/durable goods orders

- Backlogs of works/capacity indicators

- Supplier delivery times

- Inventory indicators

- Purchasing activity

Global coverage

PMI data are available for over 40 countries across a range of broad sectors:

| Manufacturing Australia Austria Brazil Canada China Colombia Czech Republic France Germany Greece India Indonesia Ireland Italy Japan Malaysia Myanmar Mexico Netherlands Philippines Poland Russia South Korea Spain Taiwan Thailand Turkey United Kingdom United States Vietnam GLOBAL EUROZONE ASEAN | Services Australia Brazil China France Germany India Ireland Italy Japan Russia Spain United Kingdom United States GLOBAL EUROZONE | Whole Economy Egypt* Ghana Hong Kong Kenya Lebanon Mozambique Nigeria Qatar* Saudi Arabia* Singapore South Africa Uganda United Arab Emirates* Zambia *Non-oil sector | Construction France Germany Ireland Italy United Kingdom EUROZONE |

Sector coverage

In addition to providing national macroeconomic indicators, PMI data are also compiled for detailed sectors for a number of regions, allowing specific industry trends to be monitored:

| Global | Europe | Asia | US | |

| Basic Materials | • | • | • | • |

| Chemicals | • | • | • | |

| Resources | • | • | • | |

| Forestry & Paper Products | • | • | • | |

| Metals & Mining | • | • | • | |

| Consumer Goods | • | • | • | • |

| Automobiles & Auto Parts | • | • | • | |

| Beverages & Food | • | • | • | |

| Food | • | • | ||

| Beverages | • | • | ||

| Household & Personal Use Products | • | • | • | |

| Consumer Services | • | • | • | • |

| Media | • | • | ||

| Tourism & Recreation | • | • | ||

| Consumer Cyclicals | • | |||

| Consumer Non-cyclicals | • | |||

| Financials | • | • | • | • |

| Banks | • | • | • | |

| Insurance | • | • | ||

| Other Financials | • | • | ||

| Real Estate | • | • | • | |

| Healthcare | • | • | • | • |

| Healthcare Services | • | • | • | |

| Pharmaceuticals & Biotechnology | • | • | • | |

| Industrials | • | • | • | • |

| Industrial Goods | • | • | • | |

| Machinery & Equipment | • | • | • | |

| Construction Materials | • | • | • | |

| Industrial Services | • | • | • | |

| Commercial & Professional Services | • | • | • | |

| General Industrials | • | • | • | |

| Construction & Engineering | • | |||

| Transportation | • | • | • | |

| Technology | • | • | • | • |

| Technology Equipment | • | • | • | |

| Software & Services | • | • | • | |

| Telecommunication Services | • |

Experts

Chris Williamson

Chris is Chief Business Economist and an executive director at IHS Markit. Mr Williamson is a well-known economic commentator and is regularly quoted in international business print and broadcast press, and frequently speaks at conferences on global economic issues. Mr. Williamson also sits on a number of economic advisory panels.Chris joined the company in 2008 following the acquisition of NTC Economics, a provider of global macro-economic indicators, where he played a major role developing a world-leading provider of business surveys and economic indicators, including the PMI series. PMI surveys now encompass all major economies and are commonly cited as some of the most important sources of economic information available to central banks, financial markets and business decision makers.Chris studied Economics at the University of Nottingham and Economic Development at the University of Manchester.

- Financial Services

- Financial Indices

- Purchasing Managers' Index (PMI)

View Profile

Jingyi Pan

Ms. Pan joined the company and its PMI team in 2021, bringing with her research experiences across both macroeconomics and financial markets. Her focus is on the Asia-Pacific region and can often be seen sharing her analysis and commentary across international business print and broadcast press.Prior to joining the company, Ms. Pan had been a Senior Market Strategist with an investment brokerage firm and had work experience in economic forecasting, planning and policy. Jingyi received her Bachelor of Social Sciences (Honours) in Economics from the National University of Singapore and Master of Science in Applied Finance from the Singapore Management University. Ms. Pan is bilingual in English and Chinese.

- Financial Services

- Financial Indices

- Financial Services

- Purchasing Managers' Index (PMI)

View Profile

Events

IHS Markit Webinar 06 November 2020

PMI™ by IHS Markit Global - How global econom (...)

(...)

IHS Markit Webinar 07 October 2020

COVID-19 Update — PMI™ by IHS Markit Global W (...)

(...)

IHS Markit Webinar 08 September 2020

PMI™ by IHS Markit Global Webcast (on demand)

(...)

PMI Resources

Solutions you may also be interested in

Explore

- Financial Services

Follow Us

October #PMI data revealed growth in the EZ cooled amid weaker expansions in the manufacturing and service sectors.… https://t.co/FGlTZmk1Bs

Nov 18

RT @WilliamsonChris: UK CPI #inflation up to decade high of 4.2% in October with #PMI data on firms' input costs suggesting it has further…

Nov 17

RT @IHSMarkit: The Great Supply Chain Disruption will continue into 2022. But what does that mean? Join a panel of @IHSMarkit experts as…

Nov 16

{}

{"items" : [ {"name":"login","url":"","enabled":false,"desc":"Product Login for existing customers","alt":"Login","large":true,"mobdesc":"Login","mobmsg":"Product Login for existing customers"},{"name":"facts","url":"","enabled":false,"desc":"","alt":"","mobdesc":"PDF","mobmsg":""},{"name":"sales","override":"","number":"[num]","enabled":true,"desc":"Call Sales</br><strong>[num]</strong>","alt":"Call Sales</br>[num]","mobdesc":"Sales","mobmsg":"Call Sales: [num]"}, {"name":"chat","enabled":true,"desc":"Chat Now","mobdesc":"Chat","mobmsg":"Welcome! How can we help you today?"}, {"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fihsmarkit.com%2fproducts%2fpmi.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fihsmarkit.com%2fproducts%2fpmi.html&text=Purchasing+Managers%e2%80%99+Index%c2%ae+(PMI%c2%ae)+%7c+IHS+Markit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fihsmarkit.com%2fproducts%2fpmi.html","enabled":true},{"name":"email","url":"?subject=Purchasing Managers' Index® (PMI®) | IHS Markit&body=http%3a%2f%2fihsmarkit.com%2fproducts%2fpmi.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Purchasing+Managers%e2%80%99+Index%c2%ae+(PMI%c2%ae)+%7c+IHS+Markit http%3a%2f%2fihsmarkit.com%2fproducts%2fpmi.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"} ]}

What Does Pmi Stand for in Finance

Source: https://ihsmarkit.com/products/pmi.html

0 Response to "What Does Pmi Stand for in Finance"

Post a Comment